Q2 2024 Market Pulse Survey Results

The Market Pulse Survey is a poll of licensed real estate professionals and members of the East Tennessee REALTORS®. The Q2 2024 iteration of the survey was conducted online from June 13-20, 2024, and received a total of 166 responses.

Key Findings

- Buyer traffic decreased nominally in the second quarter of 2024. Sixteen percent of respondents reported seeing more buyer traffic than this time last year, compared to 21% last quarter. Similarly, seller traffic decreased with 17% of respondents reporting more seller traffic than this time last year, compared to just 20% last quarter.

- REALTORS® expectations about buyer and seller traffic over the next three months diminished in the second quarter of 2024 after multiple quarters of improving expectations. 22% of respondents expect more buyer traffic than this time last year, compared to 32% last quarter. Expectations about future seller traffic, reduced with 22% of respondents expecting seller traffic to increase compared to this last time last year.

- The typical home sold in Q2 2024 received an average of 2.7 offers, less than a year ago but up from 2.2 offers in Q1 2024.

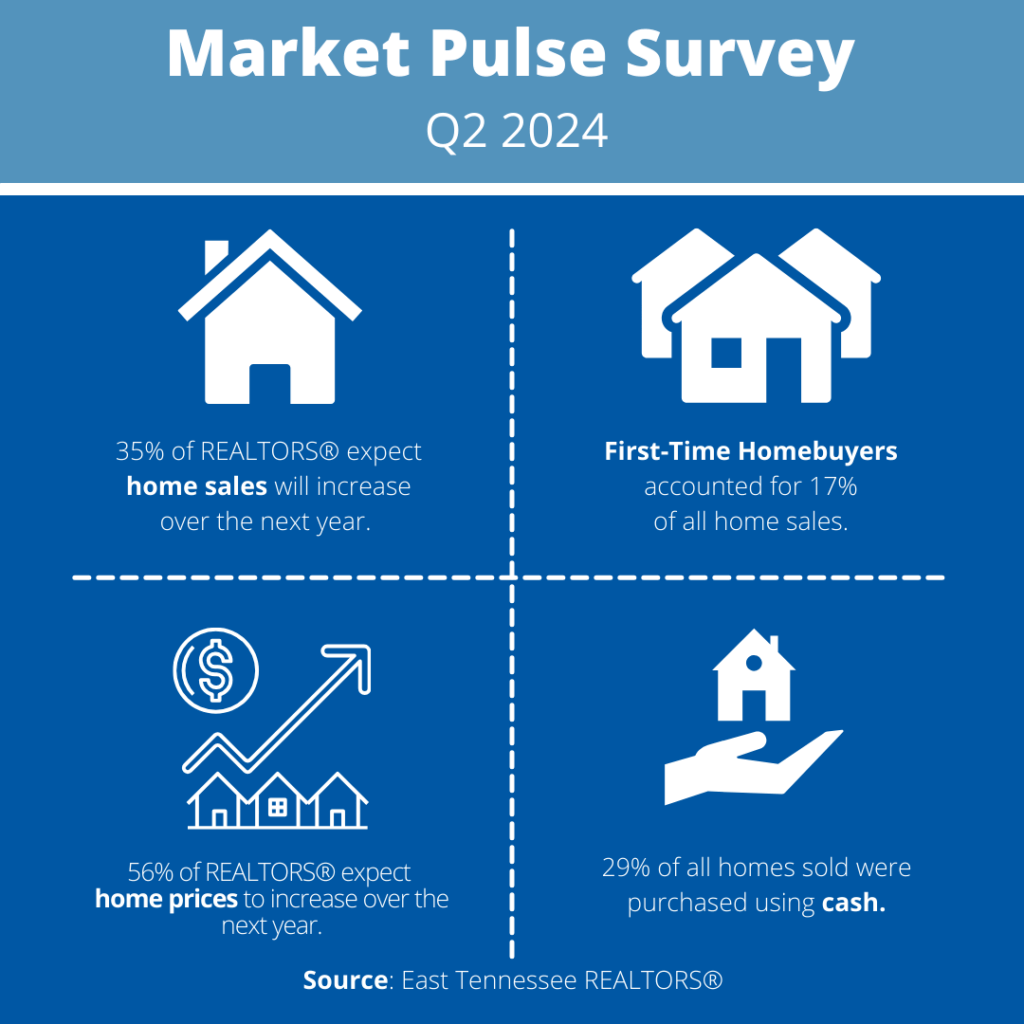

- There was a dramatic decrease in the percentage of REALTORS® who expect home sales will increase over the next year with only 35% supported this whereas in Q1 2024 51% REALTORS® expected an increase in home sales. This quarter the percentage of REALTORS® expecting an increase is closer to Q2 2023.

- 56% of REALTORS® expect home prices will increase over the next year, while 17% expect no change and 27% expect prices to decline over the next year.

- All-cash sales represented 29% of all home sales in Q2 2024, which has remained stagnant over the past year.

- 53% of buyers in the past three months waived at least one contingency in their purchase contract, down from 55% a year ago and 60% in Q1 2024.

- Among homes that went under contract in Q2 2024, 10% had an appraised value that was less than the contract price. This has remained in the same range for the past year.

| Market Outlook | Q2 2024 | Q2 2023 |

| Percent of respondents who expect a year-over-year increase in buyer traffic in next 3 months | 22% | 12% |

| Percent of respondents who expect a year-over-year increase in seller traffic in next 3 months | 22% | 11% |

| Percent of respondents who expect home sales to increase over the next year | 35% | 33% |

| Percent of respondents who expect home prices to increase over the next year | 56% | 64% |

| Key Market Indicators | Q2 2024 | Q2 2023 |

| Median days on market | 14 | 8 |

| First-time homebuyers, as percent of sales | 17% | 17% |

| Sales for non-primary residence use, as a percent of sales | 13% | 12% |

| Cash sales, as percent of sales | 29% | 30% |

| Off-market, as percent of sales | 9% | 12% |

| Average number of offers received on the most recent sale | 2.7 | 3.0 |

| Buyer and Seller Trends | Q2 2024 | Q2 2023 |

| Percent of sellers moving somewhere else in current city/county | 41% | 50% |

| Percent of sellers moving somewhere else in Tennessee | 23% | 23% |

| Percent of sellers moving to a different state/outside of Tennessee | 35% | 27% |

| Percent of buyers moving due to relocation (such as for business or a job change) | 16% | 26% |

| Percent of buyers who were previously renting | 29% | 28% |

| Percent of buyers who are repeat homebuyers | 53% | 59% |

| Other Market Indicators | Q2 2024 | Q2 2023 |

| Percent of buyers who waived at least one contingency | 53% | 55% |

| Percent of buyers who waived inspection contingency | 16% | 14% |

| Percent of buyers who waived appraisal contingency | 22% | 20% |

| Percent of contracts where appraised value met or exceeded the contract price | 90% | 91% |

| Percent of contracts in the past 3 months that were terminated | 6% | 5% |

| Percent of contracts in the past 3 months that had delayed settlement | 17% | 14% |

| Percent of contracts in the past 3 months that closed/settled on time | 76% | 80% |

| Percent of respondents who have worked with an investor buyer in the past three months | 40% | 30% |

| Percent of respondents who listed 3+ properties in the past month | 24% | 24% |

| Percent of respondents currently working with 3+ clients actively/seriously looking to purchase a home | 40% | 39% |

| Source: East Tennessee REALTORS® | ||

| Note: Estimates based on East Tennessee REALTORS® quarterly Market Pulse Survey and MLS data. | ||

| Copyright © 2024 EAST TENNESSEE REALTORS® | ||

About the Survey

- The Market Pulse Survey gathers on-the-ground information about local market conditions from members of East Tennessee REALTORS® based on their client interactions and real estate transactions in the previous three months.

- The Market Pulse Survey is provided by East Tennessee REALTORS® solely for use as a reference. Reproduction, reprinting or retransmission in any form is prohibited without written permission.

- Media inquiries about the survey should be directed to communications@etnrealtors.com.

Data Attribution: You are welcome to use or reproduce this survey data for your own purposes, but we ask that you attribute any full or partial use of the data to East Tennessee REALTORS® and include the time period when the survey was conducted.

| Copyright © 2024 EAST TENNESSEE REALTORS® |